Key Takeaways

- Private investments are increasingly favored as a strategy to diversify and stabilize portfolios during economic volatility.

- Access to unique, less liquid opportunities distinguishes private markets from traditional, public ones.

- Proper due diligence, patience, and a long-term perspective are crucial for success in private investments.

- The landscape is evolving, making private market access more attainable to individual investors than ever before.

Table of Contents

- Introduction

- Understanding Private Investments

- Why Private Markets Thrive in Uncertain Times

- Key Strategies for Private Investing

- Risks and Considerations

- Emerging Trends in Private Investing

- Conclusion

Introduction

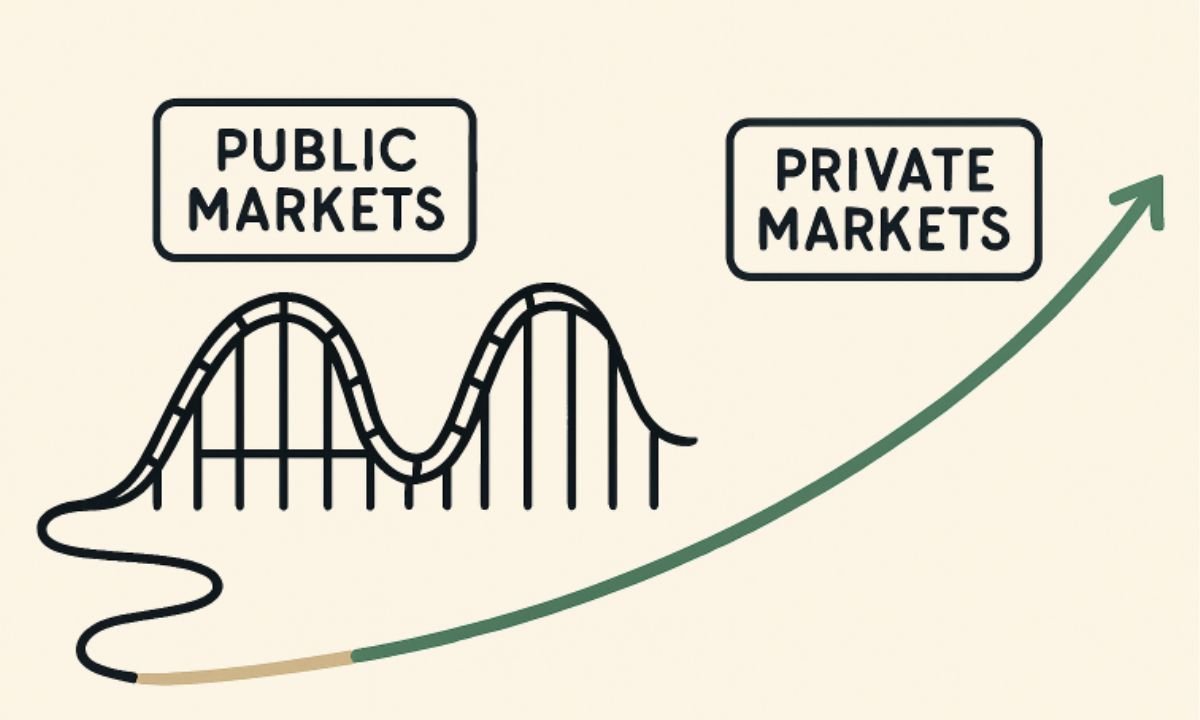

Investors across the globe are reevaluating their strategies amid inflation, recession threats, and increased volatility in public markets. With conventional approaches no longer guaranteeing stability, many have turned their attention to alternatives that can weather economic storms. Today, private investing opportunities are a smart choice during uncertain times, enabling prudent investors to build defensible, resilient portfolios beyond the reach of mainstream assets.

Unlike stocks and bonds, which are subject to daily market sentiment, private investments can shelter capital from the unpredictable headlines and shocks that rattle public markets. Their potential for outsize returns and structural differences make private markets uniquely appealing for those seeking security and growth despite broader market uncertainty.

These advantages are particularly crucial as investors strive to counteract headwinds stemming from tightening monetary policy and global unrest. Private markets, with their selective accessibility and longer-term horizons, offer opportunities to build wealth through sectors and companies not always available on public exchanges.

The lessons of economic resilience and strategic capital placement are increasingly relevant—especially as the pace and scope of change in global financial systems accelerate.

Understanding Private Investments

Private investments encompass assets not traded on public exchanges, including private equity, private credit, venture capital, infrastructure, and real estate. These instruments are often restricted to qualified investors, but regulatory changes have made them increasingly accessible. Private investment funds typically pool capital from limited partners to invest in targeted opportunities that are often out of reach for individual retail investors.

The distinguishing feature of private investments is their illiquidity: assets cannot be bought or sold quickly. The potential for greater returns offsets this limitation, as illiquidity and longer time horizons incentivize patient investors and experienced managers to seek and nurture value across economic cycles.

Why Private Markets Thrive in Uncertain Times

When public markets become volatile, private markets tend to remain stable by following fundamentals rather than fleeting news cycles. The mechanics of pricing in private markets mean valuations are revisited less frequently, reducing panic-driven asset devaluations. In periods when traditional lending tightens, private credit providers step up, filling critical gaps that keep businesses and real assets afloat.

Private assets are also insulated from the kind of “herd mentality” that often drives dramatic swings in public equities, allowing for more rational, long-term capital deployment. Managers focus on value creation without the distraction of meeting quarterly earnings estimates, resulting in a strategic and often more robust investment environment even in difficult times.

Key Strategies for Private Investing

Diversification

Effective private portfolios are diversified, allocating capital across multiple asset classes and geographic regions. A combination of private equity, real assets, and infrastructure, for example, reduces the risk of concentrated exposure to any single sector or downturn. According to Investopedia, diversification is a key strategy for managing risk and improving long-term portfolio stability, helping investors avoid the pitfalls of overconcentration in a single asset.

Due Diligence

Rigorous diligence—on fund managers, target assets, governance, and industry—remains non-negotiable. Evaluating the alignment of interests, track records, and structural safeguards protects investors from adverse surprises and unchecked risk.

Long-Term Perspective

Adopting a patient, years-long outlook is essential. Since value in private investments typically compounds gradually as businesses mature or projects are realized, sticking to a well-defined investment thesis is key to weathering interim economic shocks.

Risks and Considerations

The advantages of private investing do come with trade-offs. Illiquidity means funds are often committed for years, restricting their flexibility. Unlike exchange-traded funds, private vehicles commonly charge higher management and performance fees, which eat into net returns. Transparency is another concern: Private assets are not subject to the same disclosure requirements as public ones, increasing the importance of selecting reputable sponsors and managers. Navigating regulatory and tax issues, especially internationally, also requires specialized expertise.

Emerging Trends in Private Investing

Today, the private investing landscape is experiencing a wave of democratization. Fintech innovation and regulatory modernization have enabled high-net-worth individuals to access vehicles long dominated by institutions. Financial giants offer curated opportunities to private investors, signaling growing mainstream acceptance of alternative assets.

Meanwhile, sectors attracting new capital are rapidly evolving. Technology, health care innovation, and sustainable infrastructure (from renewable energy to digital infrastructure) are at the forefront. Investors can align their portfolios not just for financial gain, but also to help shape transformative advances—underscoring the societal impact of thoughtful private investment.

Conclusion

As financial markets continue to adapt to new realities, private investing stands out as a forward-looking strategy. With a robust approach to diligence, diversification, and a long-term view, investors can unlock opportunities for growth and resilience that remain elusive to public markets—particularly in times of uncertainty. Those prepared to embrace this evolving asset class will be better equipped to navigate volatility and achieve their financial goals.

READ ALSO: fintechzoom.com STOXX 600: A Beginner’s Guide to Investing in the European Index