Assume applying for a mortgage, and instead of weeks of paperwork and anxious credit checks, the lender instantly verifies your responsible borrowing history directly from an unchangeable, global record. Sounds futuristic? Welcome to the emerging world of traceloans. In 2023 alone, blockchain-based lending protocols saw over $100 billion in transaction volume, hinting at a massive shift towards transparent finance. Yet, amidst this growth, a crucial question lingers: Can this radical visibility truly rebuild trust in lending? Let’s demystify traceloans.

What Exactly Are Traceloans?

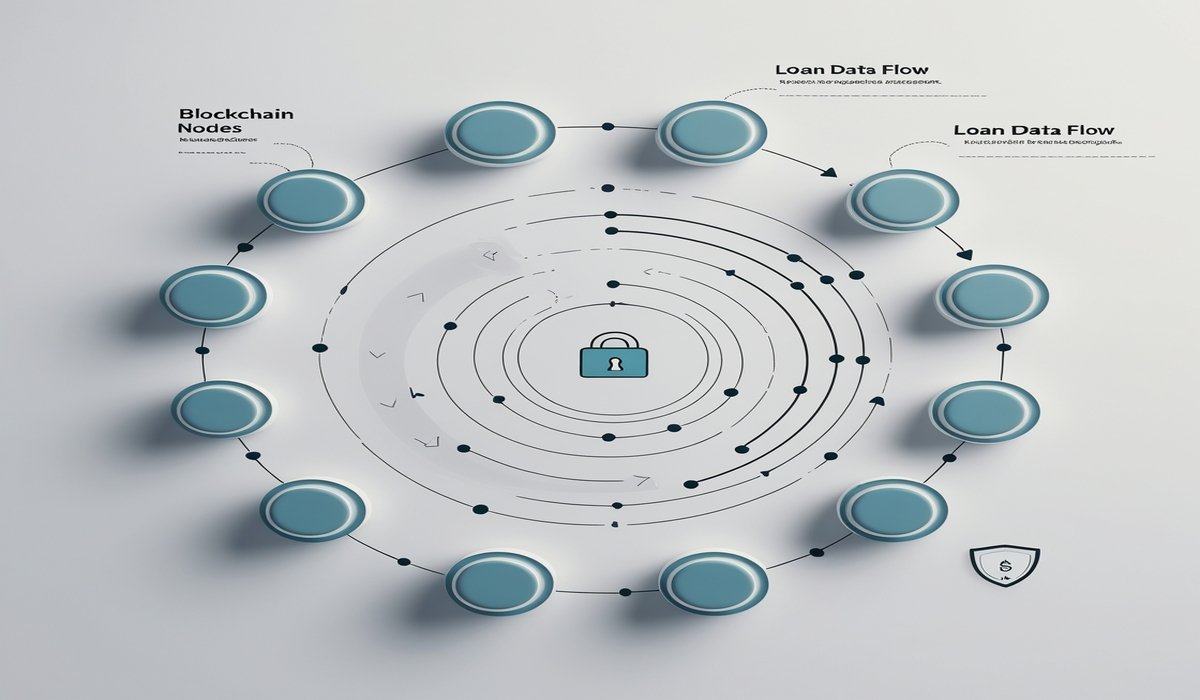

At its core, a traceloan is a loan agreement where every single transaction, repayment, modification, and even ownership transfer is permanently and publicly recorded on a blockchain – a decentralized, digital ledger. Think of it like a financial diary etched in unbreakable glass, visible to all permitted parties.

- The Transparency Promise: Unlike traditional loans hidden in bank databases, traceloans offer an unprecedented level of openness. Borrowers know their data is accurate; lenders see verifiable histories; regulators gain real-time oversight.

- Beyond Blockchain Hype: While powered by blockchain technology, traceloans aren’t just crypto jargon. They represent a fundamental shift in how lending data is stored and shared, applicable to various asset types.

Key Components of a Traceloan System:

- The Blockchain Ledger: The immutable foundation. Once data is added (like a payment), it cannot be altered or deleted.

- Smart Contracts: Self-executing code that automates loan terms (e.g., releasing collateral upon full repayment, applying late fees).

- Digital Identity: Secure, verifiable ways to link borrowers/lenders to their loan history without exposing unnecessary personal data.

- Permissioned Access: Controls defining who can see specific details (e.g., borrower sees all; regulator sees anonymized trends; public sees only that a loan exists).

How Traceloans Work: A Step-by-Step Journey

Let’s follow Maria, a small business owner, as she secures a traceloan:

- Application & On-Chain Verification: Maria applies via a traceloan platform. Instead of faxing bank statements, she securely grants access to her verified financial history already recorded on the blockchain (e.g., past repaid microloans, verified income streams). Her digital identity is cryptographically confirmed.

- Smart Contract Creation: The lender (or an automated protocol) defines the loan terms (amount, interest, duration, collateral) within a smart contract. This contract code is deployed onto the blockchain. Imagine a vending machine programmed only to release the snack when exact change is inserted.

- Funding & Disbursement: Once Maria accepts the terms (digitally signed), the loan is funded. Funds (crypto or tokenized fiat) are transferred directly to her digital wallet. This transaction is instantly recorded on the ledger – Loan ID: XYZ, Amount: $10,000, Borrower: Maria’s Verified ID, Timestamp: [Date].

- Transparent Repayments: Maria makes her monthly payments via the platform. Each payment triggers the smart contract:

- Records the payment amount and date immutably.

- Automatically reduces the outstanding principal.

- Releases a tiny portion of her collateral (if applicable) as the loan amortizes.

- Lifecycle Visibility: If Maria sells her business loan to another investor? That transfer is recorded. If terms are renegotiated (with mutual consent)? The amended contract is recorded as a new version, linked transparently to the original. Full traceability is the hallmark.

(Visualize a simple flowchart here: Application -> Verification -> Smart Contract Deployment -> Funding (Blockchain Record) -> Repayments (Automated Recording) -> Loan Completion/Transfer)

Why the Buzz? Tangible Benefits for Everyone

The traceloan model isn’t just tech for tech’s sake. It solves real pain points:

For Borrowers:

- Build Verifiable Credit: Especially crucial for the “credit invisible” or those in developing economies. Responsible repayment is permanently provable, creating a portable financial reputation.

- Reduce Bias: Decisions rely more on transparent, on-chain data than opaque scoring models or potential human bias.

- Faster Access: Streamlined verification can significantly cut approval times.

- Own Your Data: Potential for borrowers to control and selectively share their verified loan history.

For Lenders:

- Lower Risk & Fraud: Immutable history makes fraud (like loan stacking) much harder. Collateral management is automated and transparent.

- Improved Efficiency: Automation via smart contracts slashes administrative costs (paperwork, manual reconciliation).

- Enhanced Due Diligence: Access to a borrower’s actual historical performance, not just a snapshot credit score.

- New Markets: Ability to securely lend to previously underserved populations with verifiable, alternative data.

For Regulators & the System:

- Real-Time Oversight: Potential for monitoring systemic risk and compliance without burdensome audits.

- Increased Market Stability: Transparent record-keeping reduces hidden leverage and “black box” operations.

- Standardization & Interoperability: Blockchain-based records can potentially work across institutions and borders more easily.

Real-World Applications: Beyond Theory

Traceloans are moving out of labs and into practice:

- Supply Chain Finance: A farmer in Kenya receives an advance against their future crop yield. Repayments and crop sales are recorded on-chain, building their creditworthiness for future traceloans. Suppliers and buyers track the flow transparently.

- Mortgage Innovation: Pilot projects explore putting property titles and mortgage payments on blockchain. This simplifies refinancing, sales (“title search” becomes instant verification), and prevents fraud.

- Small Business Lending (SMB): Platforms use blockchain to pool investor funds and issue traceloans to SMBs with transparent repayment flows, attracting investors seeking verifiable returns.

- Peer-to-Peer (P2P) Lending 2.0: P2P platforms leverage blockchain for immutable loan agreements and automated repayments, boosting trust between strangers.

Addressing the Elephant in the Room: Challenges

No innovation is perfect. Key hurdles for traceloans include:

- Scalability & Cost: Can blockchain networks handle millions of loans cheaply and quickly? Solutions like Layer 2 protocols are emerging.

- Privacy Paradox: How do you balance transparency with data privacy? Zero-knowledge proofs (ZKPs) allow verification without revealing underlying data – a crucial area of development. Think proving you’re over 21 without showing your birthdate.

- Regulatory Uncertainty: Governments are still catching up. Clear frameworks are needed for widespread adoption.

- User Onboarding: Making blockchain interfaces intuitive for non-tech users remains a challenge.

- Data Oracles: Connecting real-world events (e.g., property appraisals, business revenue) securely to the blockchain requires trusted data feeds.

Read also: Small Business Financing: Beyond Banks to Creative Funding

Traceloans vs. Traditional Loans: A Quick Glance

| Feature | Traditional Loan | Traceloan |

| Record Keeping | Centralized (Bank Database) | Decentralized (Blockchain) |

| Transparency | Low (Opaque to borrower & others) | High (Configurable visibility) |

| Immutability | Records can be altered (error/fraud) | Records are permanent & unchangeable |

| Process | Manual-heavy, slow verification | Automated (Smart Contracts), Faster |

| Credit Building | Relies on Bureau Scores | Relies on On-Chain Verifiable History |

| Access | Barrier-heavy for underserved | Potential for Broader Inclusion |

The Future of Finance? What Lies Ahead

The trajectory for traceloans points towards deeper integration:

- Hybrid Models: Traditional banks adopting blockchain backends for specific loan products to gain efficiency and transparency benefits.

- Interoperable Credit Histories: Your traceloan repayment in one country could seamlessly support a loan application elsewhere.

- DeFi Integration: Traceloans becoming a core primitive within Decentralized Finance (DeFi) ecosystems for collateralized borrowing/lending.

- AI & Analytics: Transparent loan data feeding powerful AI models for better risk assessment and personalized products.

Key Takeaways & Your Next Steps

Traceloans offer a compelling vision: lending built on bedrock transparency and automation. While challenges exist, the potential to reduce friction, increase access, and rebuild trust is immense.

Here’s what you can do now:

- Stay Curious: Follow developments in blockchain finance (DeFi, Central Bank Digital Currencies – CBDCs) – they often intersect with traceloans.

- Explore Platforms: Research emerging lending platforms (like Centrifuge, Goldfinch, or bank-led pilots) using this tech. Understand their user experience.

- Consider Your Data: Think about your own financial footprint. How might verifiable, portable data benefit you in the future?

- Demand Transparency: Support institutions and technologies pushing for clearer, fairer financial systems.

The era of hidden financial histories is fading. Traceloans illuminate the path forward, promising a future where trust isn’t assumed, but visibly, verifiably earned. Are you ready to see where your financial footprint leads?

FAQs:

- Q: Are traceloans only for cryptocurrency?

A: Not necessarily! While often facilitated using crypto/tokens, the underlying asset being financed could be fiat currency, real estate, invoices, or physical goods. The core innovation is the traceable record on the blockchain. - Q: Does “transparent” mean everyone can see my personal loan details?

A: Absolutely not! Privacy is paramount. Traceloan systems use sophisticated cryptography. While the existence and key terms (like amount, status) might be public or semi-public, sensitive personal data (your name, address, SSN) is protected. Access is typically permissioned – you control who sees what. Zero-knowledge proofs are key tech here. - Q: What happens if I lose access to my digital wallet? Can I repay my traceloan?

A: This is a critical consideration. Losing your private keys (like losing the only key to a safety deposit box) can be catastrophic. Reputable traceloan platforms offer robust recovery options (like multi-signature wallets or social recovery). Always understand the security and recovery mechanisms before engaging. - Q: Are traceloans regulated?

A: Regulation is evolving rapidly. Currently, it depends heavily on the jurisdiction, the platform’s structure, and the nature of the assets involved. Some operate in regulatory gray areas, while others actively seek licenses. Expect regulations to catch up as adoption grows. - Q: How do traceloans help people with no credit history?

A: This is a major potential benefit! Traceloans can incorporate alternative, verifiable data sources (like consistent utility payments, rental history, or business transaction records on-chain). Repaying a small traceloan creates an immutable, positive credit record visible to future lenders, building credit from scratch. - Q: Are traceloans more expensive than traditional loans?

A: It varies. While blockchain transaction fees (gas fees) can be a cost, traceloans often eliminate significant manual overhead for lenders. This could lead to lower interest rates, especially for borrowers who present lower risk due to their transparent positive history. However, early-stage tech often carries a premium. - Q: Can a traceloan be modified or forgiven?

A: Yes, but transparently! If both borrower and lender agree to modify terms (e.g., extend the term, reduce payments), a new smart contract version is created and recorded on the blockchain, linked to the original. Forgiveness would also be recorded as a final transaction. The entire history, including changes, remains traceable.

You may also like: Stop the Scrolling, Start the Saving: Your gomyfinance.com Saving Money Game Plan